Introduction

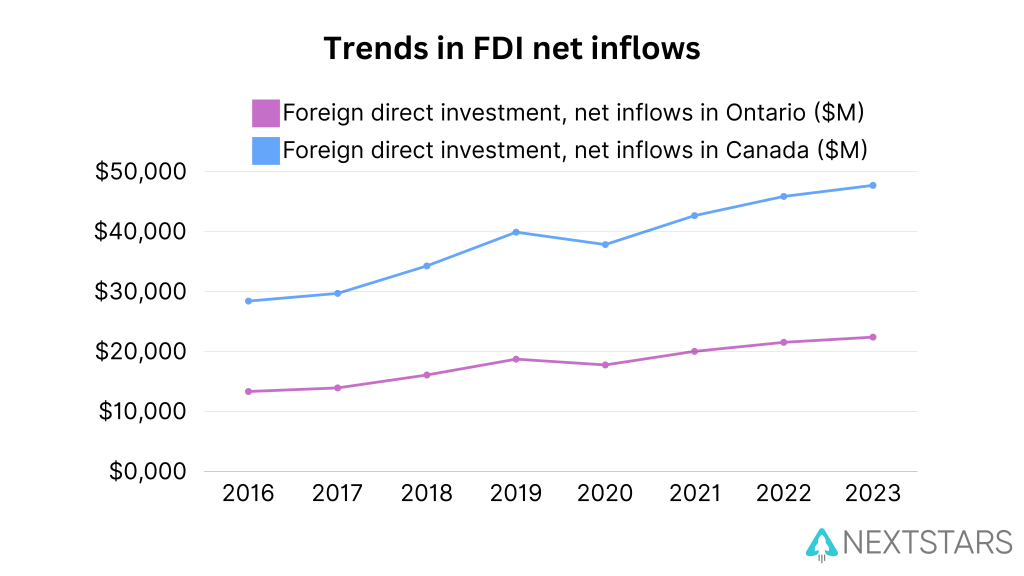

In 2023, Ontario attracted over $22 billion in foreign direct investment (FDI), showing why it’s one of the best places to invest in Canada. With major projects like Canada’s first electric vehicle supply chain, led by companies like Honda, Ontario is building the future of innovation.

Whether you’re looking to gain residency through investment or grow your business in a new market, Ontario has everything you need. The province offers a talented workforce, great infrastructure, and government programs that make it easier to succeed.

This guide will show you why Ontario is a smart place to invest, the types of investments you can make, and the key industries and programs to watch.

Why Ontario?

Ontario has established itself as a global hub for foreign investment, offering unparalleled opportunities through its robust economy, strategic location, skilled workforce, and business-friendly policies. Here’s why Ontario is the destination of choice for investors worldwide:

1. Economic Strength

As Canada’s largest provincial economy, Ontario contributes nearly 40% to the nation’s GDP. In 2023, the province demonstrated resilience, with real GDP growth outpacing national averages, driven by strong consumer spending and growing export demand. This stability makes Ontario a secure and lucrative destination for investment.

(Source: Ontario Economic Outlook and Fiscal Review)

2. Strategic Location

Located at the heart of North America, Ontario provides investors access to over 194 million consumers within a day’s drive from the Greater Toronto Area. Key trade agreements like CUSMA (Canada-United States-Mexico Agreement) enhance Ontario’s position as a gateway to the North American market. Pearson International Airport, one of North America’s busiest, ensures seamless global connectivity for businesses.

Invest Ontario

3. Skilled Workforce

Ontario’s workforce is its strongest asset. With over 55,000 new STEM graduates annually, the province provides a highly educated talent pool to fuel innovation and growth. This skilled workforce supports industries like technology, advanced manufacturing, and life sciences, making Ontario a global leader in these fields.

Invest Ontario Annual Business Plan

4. Business-Friendly Environment

Ontario offers a competitive and supportive business environment. Companies operating in the province benefit from lower healthcare costs compared to the U.S., a significant advantage for business sustainability. Additionally, programs like the Ontario Innovation Tax Credit provide valuable incentives for businesses investing in research and development.

Invest Ontario

Investing in Ontario means leveraging a thriving economy, strategic market access, top-tier talent, and a supportive business environment—all within a province committed to fostering innovation and sustainable growth.

Analyzing Ontario’s FDI Trends

In 2023, Ontario attracted $22 billion in FDI, outpacing major global economies and showcasing its economic diversity. With growth in corporate operations and innovation-driven sectors, and a shift away from resource-heavy industries, Ontario continues to position itself as a leading destination for sustainable, high-value investments. Canada Statistic World Bank

A $22 Billion Perspective in 2023

In 2023, Ontario attracted approximately $22 billion in Foreign Direct Investment (FDI), a testament to its growing reputation as a global investment hub. While the United States and China led the world with FDI inflows of $388 billion and $180 billion respectively, Ontario’s performance stands out, surpassing major economies such as Sweden, the United Arab Emirates, Japan, Germany, and Saudi Arabia. This achievement reflects Ontario’s strong economic fundamentals, strategic proximity to U.S. markets, and vibrant high-growth sectors like technology, clean energy, and advanced manufacturing. Coupled with government incentives, a skilled workforce, and a business-friendly environment, Ontario continues to position itself as a premier destination for global investors seeking innovation, stability, and long-term growth opportunities.

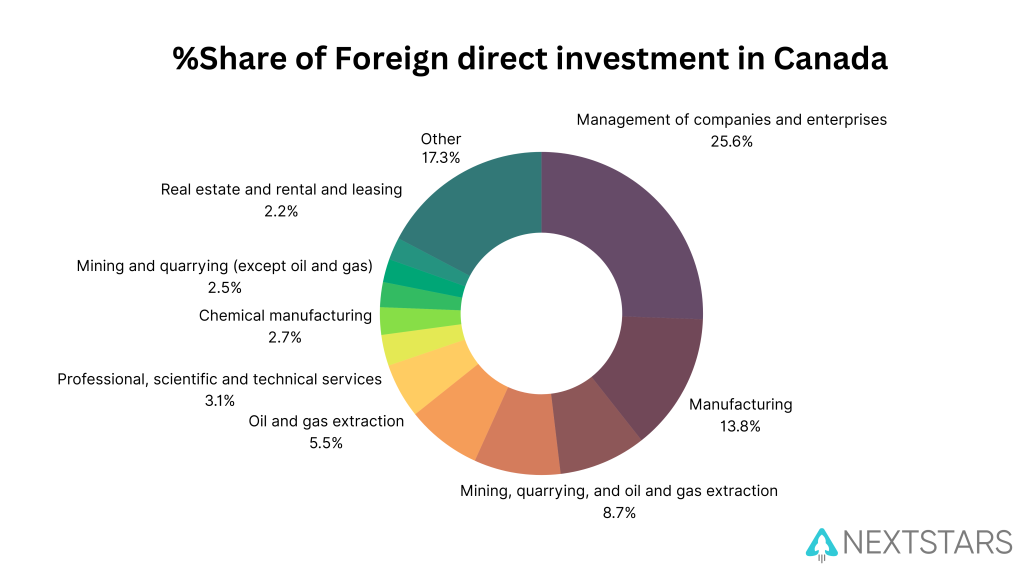

Ontario’s FDI Landscape: A Diverse Economic Powerhouse

Ontario’s Foreign Direct Investment (FDI) landscape is a testament to its economic diversity and strategic importance. Leading the way is the Management of Companies and Enterprises sector, which accounts for 25.6% of FDI, underscoring Ontario’s appeal as a hub for global corporate operations and headquarters. The Manufacturing sector follows at 13.8%, driven by Ontario’s advanced industrial base and its pivotal role in North America’s automotive and technology supply chains. Meanwhile, Mining, Quarrying, and Oil and Gas Extraction contribute 8.7%, reflecting the province’s rich natural resources and its importance in meeting global demand for minerals essential to clean energy and technology. Emerging sectors like Professional, Scientific, and Technical Services and Chemical Manufacturing are also gaining traction, showcasing Ontario’s transition toward a knowledge-based economy fueled by innovation and research.

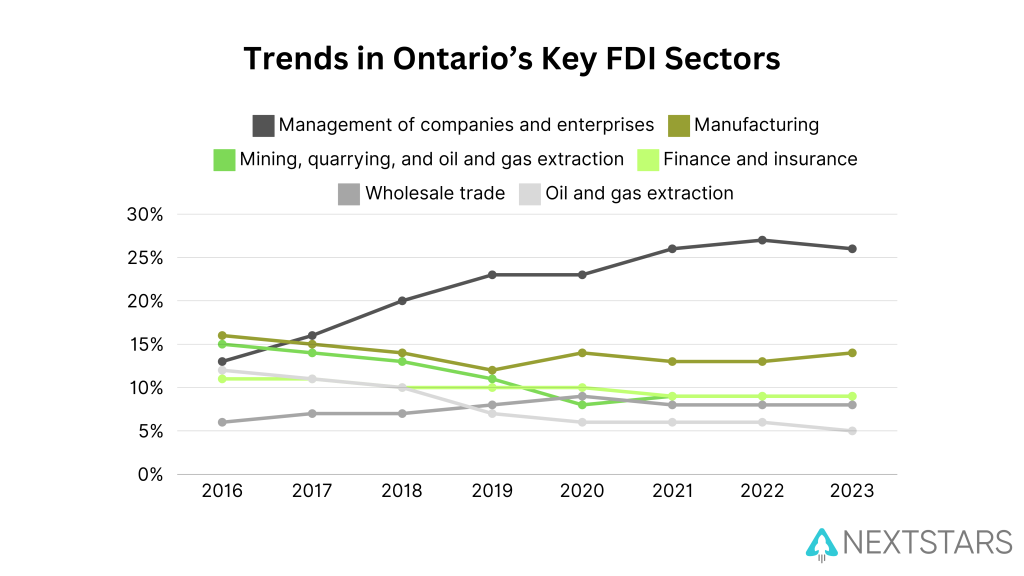

Evolving Trends in Ontario’s Key FDI Sectors

Ontario’s Foreign Direct Investment (FDI) landscape has undergone significant changes over the past seven years, reflecting shifts in global economic priorities. The Management of Companies and Enterprises sector has seen remarkable growth, rising from around 15% of total FDI inflows in 2016 to over 25% in 2023. This increase highlights Ontario’s growing importance as a hub for corporate headquarters and strategic operations, attracting businesses seeking stability and access to global markets.

In contrast, sectors like Oil and Gas Extraction and Mining, Quarrying, and Oil and Gas Extraction have experienced a steady decline. Their combined share of FDI has dropped from nearly 15% in 2016 to less than 10% in 2023, signaling a shift away from resource-based industries toward more sustainable and innovation-driven sectors.

These trends reflect Ontario’s evolving economic focus, moving from reliance on traditional industries to fostering a diverse, knowledge-based economy that attracts high-value investments and supports long-term growth.

Types of Investment Options in Ontario

Ontario offers foreign investors diverse pathways to enter its dynamic market. Each option comes with unique advantages and considerations, catering to different business goals. Here’s a concise breakdown:

1. Greenfield Investments

Definition: Establishing new operations or facilities from the ground up in Ontario.

- Advantages: Full control over operations, customized infrastructure, and alignment with long-term objectives.

- Considerations: Requires significant capital and time to set up.

- Example: Building a new manufacturing plant in Ontario to serve the North American market.

2. Mergers and Acquisitions (M&A)

Definition: Acquiring or merging with an existing Ontario-based business.

- Advantages: Immediate market entry with access to established operations, talent, and customers.

- Considerations: Requires thorough due diligence to evaluate financial health and cultural fit.

- Example: Acquiring a Canadian technology firm to expand into the North American tech sector.

3. Joint Ventures and Strategic Partnerships

Definition: Partnering with local companies to share expertise, resources, and risks.

- Advantages: Combines local market knowledge with foreign capital and innovation.

- Considerations: Requires clear agreements to manage shared control and decision-making.

- Example: Collaborating with a cleantech company to develop innovative renewable energy solutions.

4. Real Estate Investments

Definition: Investing in commercial or residential properties in Ontario.

- Advantages: Long-term asset appreciation and potential rental income.

- Considerations: Subject to market trends and regulatory requirements for foreign property ownership.

- Example: Investing in commercial real estate in Toronto’s financial district.

5. Portfolio Investments

Definition: Investing in financial instruments such as stocks, bonds, or mutual funds in Ontario.

- Advantages: Diversification and liquidity with exposure to Ontario’s thriving sectors.

- Considerations: Market volatility and no direct control over operations.

- Example: Purchasing shares in Ontario-based tech and life sciences companies.

Understanding Investor Goals

Foreign investors in Ontario can be grouped into four distinct categories based on their objectives and level of involvement. Each group has specific investment options tailored to their needs, whether they are seeking residency, expanding their business, or focusing on financial returns.

1. Active Investors Seeking Residency

Objective: Actively manage a business in Ontario to secure Canadian permanent residency.

Investment Options:

- Greenfield Investments: Establishing a new business or facility, such as a tech startup or manufacturing plant, is a common pathway for residency-seeking investors. Programs like the Start-Up Visa Program require entrepreneurs to create innovative businesses, secure support from a designated organization, and demonstrate job creation and economic impact.

(Start-Up Visa Program) – Also, Read our Guide Here. - Mergers and Acquisitions (M&A): Acquiring an existing business can be a strategic choice for active investors. However, it currently does not qualify for residency under Ontario’s immigration programs.

Note: The Ontario Immigrant Nominee Program (OINP) – Entrepreneur Stream, which previously allowed investors to obtain residency by purchasing and managing a business, was recently closed but may reopen in the future.

(OINP Updates)

2. Passive Investors Seeking Residency

Objective: Obtain Canadian residency through investments without being actively involved in business operations.

Investment Options in Ontario:

- No Passive Residency Pathway in Ontario: Currently, Ontario does not offer immigration programs for passive investors. Residency options require active business engagement, such as those under the Start-Up Visa Program.

Alternative Program:

- Quebec Immigrant Investor Program (QIIP): This is Canada’s only passive investment-based residency program. Investors must make a CAD $2 million investment in a government-approved fund. While it offers a pathway to permanent residency, applicants must commit to residing in Quebec.

(Quebec Immigrant Investor Program)

3. Active Investors Focused on Business Growth

Objective: Expand or manage business operations in Ontario without seeking residency.

Investment Options:

- Greenfield Investments: Building new facilities, such as R&D centers or logistics hubs, allows businesses to tailor operations to their needs and take advantage of Ontario’s strategic location.

Example: Establishing a supply chain hub to serve North America. - Mergers and Acquisitions (M&A): Acquiring or merging with Ontario-based businesses provides immediate market access and operational advantages.

Example: Purchasing a tech startup to expand into the North American market. - Joint Ventures and Strategic Partnerships: Collaborating with local businesses combines resources, shares risks, and accelerates growth in key sectors.

Example: Partnering with a cleantech company to co-develop renewable energy solutions.

4. Passive Investors Focused on Financial Returns

Objective: Generate financial returns through low-involvement investments.

Investment Options:

- Real Estate Investments: Investing in residential or commercial properties provides opportunities for rental income and long-term asset appreciation.

Example: Acquiring commercial real estate in Toronto’s financial district. - Portfolio Investments: Allocating funds into stocks, bonds, or mutual funds of Ontario-based companies offers diversification and liquidity.

Example: Investing in ETFs focusing on Ontario’s life sciences and technology sectors.

Ontario offers diverse investment opportunities, but pathways to residency are typically tied to active business involvement. The Start-Up Visa Program remains the primary option for active investors seeking residency, while the recently closed OINP Entrepreneur Stream could reopen, potentially offering new opportunities in the future. For passive residency seekers, programs like Quebec’s QIIP provide an alternative, though they require residency in Quebec. By aligning investment objectives with the right strategies, foreign investors can achieve their goals while contributing to Ontario’s thriving economy.

Addressing Key Concerns

Investing in Canada offers exciting opportunities, but it also comes with challenges that foreign investors must navigate. Below, we outline the key concerns and provide links to resources that delve deeper into each topic, offering practical advice and insights.

1. Understanding Canada’s Regulatory Landscape for Foreign Investors

Canada has a well-defined regulatory framework to balance economic development and national security. The Investment Canada Act (ICA) governs foreign investments, requiring reviews for certain transactions, especially in sensitive industries like telecommunications and critical minerals. Knowing the rules and processes ensures your investment aligns with national policies and avoids delays.

Canada’s Legal Essentials for Foreign Investors

2. Navigating Business Ownership Rules in Canada

Foreign investors enjoy the ability to fully own businesses in many sectors across Canada. However, some provinces, like Ontario, may have specific requirements, such as appointing Canadian directors for corporations. Understanding these rules is essential to establishing and running your business seamlessly.

How Can Foreign Investors Navigate Business Ownership in Canada?

3. Leveraging Canada’s Tax System and Incentives for Maximum Benefit

Foreign investors are subject to Canada’s income and capital gains taxes, but tax treaties can help reduce double taxation. Additionally, incentive programs like the SR&ED Tax Credit and clean energy credits can significantly enhance the return on your investment. Structuring your investments wisely can help you maximize these benefits.

What Taxes and Incentives Should Foreign Investors Know About in Canada?

4. Identifying High-Potential Sectors for Investment in Canada

Canada’s economy thrives in sectors like technology, clean energy, and real estate. Each sector offers growth potential and resilience against market fluctuations. Diversifying your portfolio across these industries allows you to tap into Canada’s dynamic economic opportunities.

Where Should Foreign Investors Focus Their Capital in Canada?

5. Safeguarding Your Investments in Canada

Protecting your investments involves more than just financial planning. It’s about ensuring compliance with legal requirements, securing intellectual property, and managing risks such as currency fluctuations. Partnering with local experts can help you safeguard your assets and minimize potential challenges.

How Can Foreign Investors Protect Their Investments in Canada?

Conclusion

Investing in Ontario is more than a financial move—it’s a strategic step into one of the world’s most innovative and resilient economies. The province’s strong economic foundation, diverse industries, and proactive support for foreign investment make it an attractive destination for investors seeking growth, stability, and global reach.

Success in Ontario, however, requires more than resources; it demands a deep understanding of the market, careful navigation of regulatory frameworks, and alignment of strategies with well-defined goals. Whether your focus is on securing residency, expanding operations, or diversifying your portfolio, Ontario offers a unique blend of opportunity and support to help you achieve your objectives.

By addressing challenges proactively—leveraging expert advice, utilizing available incentives, and targeting high-growth sectors—investors can not only protect their investments but also become valuable contributors to Ontario’s innovation-driven growth. The real question isn’t whether to invest in Ontario, but how to maximize the immense potential it offers.