By: Mohammed Alanzi & Saeed Zeinali

Introduction: A New Global Innovation Order

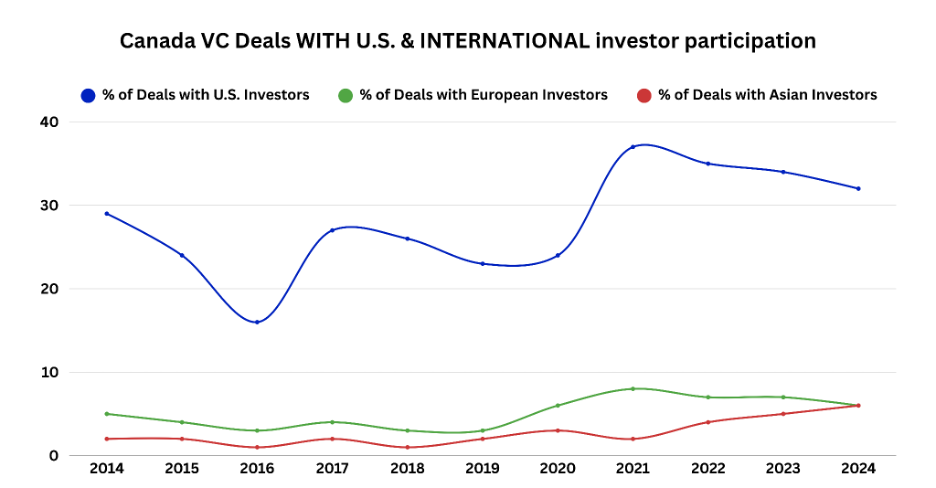

Saudi Arabia is rapidly positioning itself as a global technology powerhouse, channeling $100 billion into AI, MedTech, Cleantech, and Fintech under Vision 2030. But capital alone isn’t enough—the Kingdom needs cutting-edge startups, deep-tech expertise, and top-tier research talent to drive its transformation CVCA BNB Bloomberg. Meanwhile, Canada’s investment playbook is shifting. U.S.-backed VC deals in Canada have dropped from 37% in 2021 to 32% in 2024, signaling a need for new capital flows and market expansion. While Canada’s trade with the U.S. accounts for over a third of its GDP, its trade with Saudi Arabia remains just 0.24% of Canada’s GDP and 0.48% of Saudi Arabia’s GDP, heavily skewed toward vehicles and crude oil. This trade imbalance highlights an overlooked opportunity to foster an innovation-driven economic relationship. Government Of Canada USTR United States Trade Representative This is more than a financial shift—it’s a realignment of global innovation ecosystems. Saudi Arabia offers capital, scale, and policy incentives, while Canada brings world-class R&D, high-growth startups, and commercialization expertise. By bridging North America and MENA, this partnership can unlock investment, accelerate technology transfer, and fuel global expansion. This article examines why Saudi Arabia and Canada must rethink their innovation ties, pinpoints high-impact sector opportunities, and outlines strategies for investors and startups to capitalize on this untapped potential.

How Canada and Saudi Arabia Complement Each Other

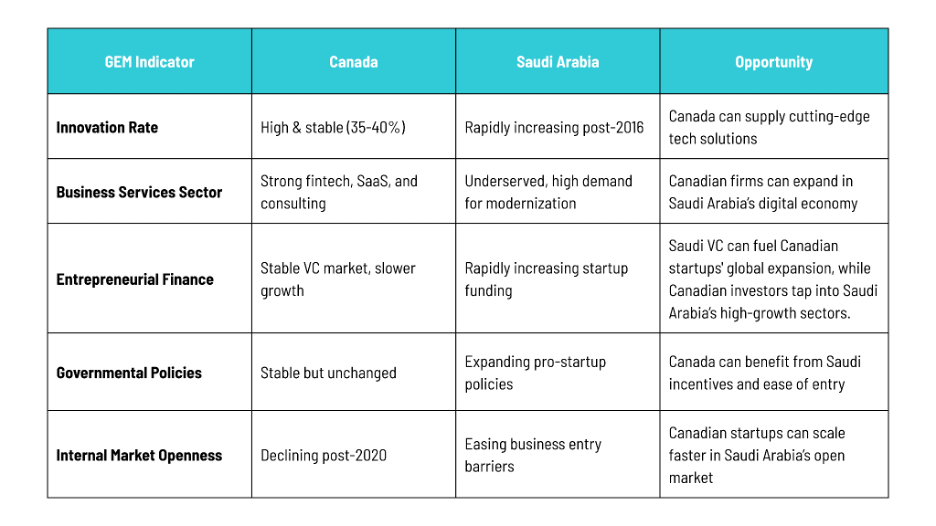

Drawing from Global Entrepreneurship Monitor (GEM) data, the Saudi-Canadian partnership reveals a compelling alignment of strengths. Canada leads in deep-tech innovation and R&D, while Saudi Arabia fuels growth with aggressive VC investment and pro-business policies. Saudi investors gain access to advanced technology and scalable startups, while Canadian firms secure capital and entry into a booming Middle Eastern market. Canadian investors are also exploring Saudi Arabia’s fast-growing sectors, from Fintech to Cleantech, leveraging policy incentives and infrastructure megaprojects. As Saudi Arabia removes barriers for foreign businesses and Canada positions itself as a North American launchpad, this collaboration is more than a capital shift—it’s a strategic alliance reshaping global innovation flows.

Summary of Key Synergies

Canada’s deep-tech expertise meets Saudi Arabia’s capital and market scale, forging a high-impact startup corridor. As Saudi Arabia accelerates investment in entrepreneurship and Canada refines its global expansion strategy, this partnership offers a dynamic pathway for scaling innovation and unlocking new economic frontiers. FundsFarm

Sector-Specific Opportunities: A Two-Way Partnership

Saudi Arabia and Canada should build a pipeline of capital, innovation, and market expansion. For Saudi investors, Canada offers a proven hub of deep-tech startups and cutting-edge R&D. For Canadian entrepreneurs, Saudi Arabia provides capital and large-scale implementation opportunities in key sectors driving global transformation.

MedTech & Life Sciences

As Saudi Arabia invests billions into AI-driven diagnostics and digital health, Canada’s MedTech firms stand to gain. The Kingdom offers funding and market demand, while Canadian startups provide the innovation and expertise to modernize healthcare.

Cleantech & Sustainability

Saudi Arabia’s renewable energy ambitions align with Canada’s leadership in sustainable tech. With Saudi capital fueling large-scale projects, Canada’s Cleantech startups have a direct path to commercialization.

Enterprise & Fintech

Saudi Arabia’s push for digital transformation is driving demand for fintech, SaaS, and automation. Canada’s startup ecosystem is a prime source for these solutions, while Saudi funding and market scale provide a launchpad for global expansion.

Bridging Ecosystems: Building a Cross-Border Innovation Pipeline

Saudi Arabia’s NTDP and Misk fuel tech expansion through funding, startup incentives, and talent development. Canada’s Start-Up Visa Program offers foreign entrepreneurs residency and market access. Additionally, Canada’s Industrial Research Assistance Program (IRAP) and Scientific Research and Experimental Development (SR&ED) Tax Credit Program provide financial support and tax incentives for R&D-driven businesses, strengthening Canada’s role as an innovation hub. These initiatives create a seamless bridge—Canadian startups tap into Saudi capital, while Saudi innovators gain entry to North America’s deep-tech ecosystem.

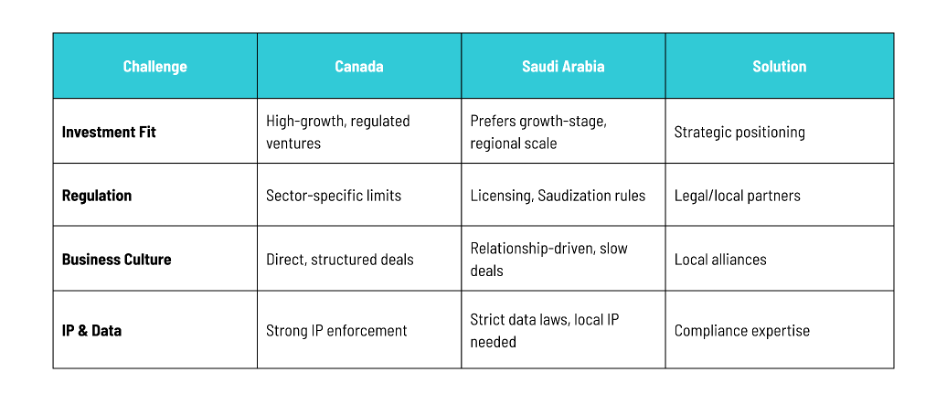

Threats & Challenges: Navigating Market Entry & Investment Expectations

Expanding into new markets isn’t just about capital—it’s about navigating regulatory frameworks, aligning with investor expectations, and adapting to business culture. For Saudi and Canadian startups and investors, overcoming these barriers is key to unlocking long-term growth.

Investment Alignment & Market Fit

Saudi investors prioritize growth-stage startups with regional scalability, while Canadian investors seek high-growth ventures with clear regulatory pathways. Securing funding requires strategic positioning, regulatory alignment, and local market adaptation.

Regulatory Adaptation: Licensing & Saudization

Despite Vision 2030’s push for foreign investment, sector-specific approvals and local hiring mandates remain hurdles. Legal counsel and Saudi partnerships streamline market entry and compliance. ATB Legal

Cultural & Business Practices

Saudi Arabia’s relationship-driven business culture shapes dealmaking. Longer negotiation cycles and trust-building are key, making local alliances and cultural fluency essential.

Read More: Investing Global Inc. Arabia

IP Protection & Data Localization

AI and MedTech startups face stringent data localization laws and IP security risks. Local patent filings and compliance expertise safeguard intellectual assets.

Addressing these challenges proactively positions startups and investors for sustainable, high-impact cross-border collaboration. White & Case Reuters

Conclusion: A High-Stakes Innovation Opportunity

Saudi-Canada startup and investment corridor is an emerging opportunity, not yet fully realized. Saudi Arabia’s venture capital market is expanding, with $247M in E-commerce/Retail and 29% international investor participation (Magnitt), as the Kingdom pivots toward AI, MedTech, and Cleantech—sectors where Canada excels in R&D, IP development and commercialization. Meanwhile, Canada’s $7.9B VC market remains strong but constrained by limited corporate investment, opening the door for Saudi capital to fuel high-growth ventures. SVC CVCA

The next step is action. We believe this is a partnership that makes sense and is to the benefit of both parties. Joint investor summits, startup programs, and accelerator partnerships can connect capital with innovation, fueling Saudi Arabia’s economic diversification and Canada’s global expansion ambitions. By strengthening this link, both nations can position themselves at the forefront of the next wave of global tech investment.